Selling online via amazon/shopify/ebay ? let us simplify your accounting

October 27, 2020

Online selling (or ecommerce) has been an increasingly important part of many small and medium

sized business(es) (SME) sales strategy over recent years, and this has only increased and

accelerated since the onset of the global pandemic, as SMEs have pivoted to provide more online

options for customers, including:

- Takeaway

- food/drink subscriptions

- online training

- consultancy etc.

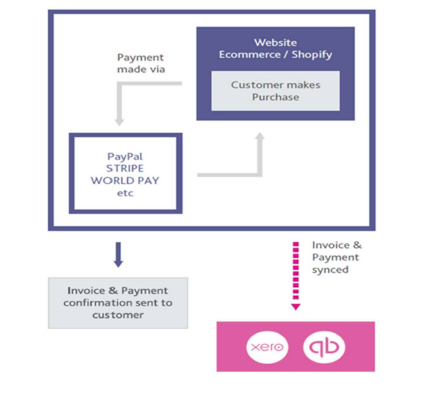

This has resulted in more activity using online marketplaces and platforms such as Amazon, Shopify,

Ebay as well as via businesses’ own websites. Whereas some platforms handle the issue of payment

processing directly (Amazon, Shopify), others (including sales via own websites) will also require the

use of a separate payment gateway provider such as Worldpay, Paypal, AMEX, Stripe etc.

WHAT ARE THE ‘PAIN POINTS’ OR PROBLEMS FOR BUSINESSES?

Where SMEs have ‘pivoted’ to recently add online sales activity to their existing activities, or where

online sales (ecommerce) have increased substantially, this adds both more volume and more

complexity to ‘day to day’ bookkeeping for the business.

Typical ‘pain points’ with online (or ecommerce) include the following:

- ‘Payouts’ from online sales transactions to businesses are generally less fees and charges

- Some platforms will also retain a ‘reserve’ or a ‘security deposit’, which is withheld from

initial and ongoing sales transactions for periods of up to 18 months - Sales transactions need to be re input manually into the accountancy system for inclusion in

business reporting and/or VAT returns etc - Some platforms e.g. Amazon, generate reports that are very tricky to understand and to use

(so re inputting transactions can be time consuming and complex) - It can be difficult to understand what ‘payouts’ are outstanding (or what sales have actually

been paid), where a separate payment gateway provider is used e.g. Stripe, Paypal, Worldpay.

In many cases, this means that 2 to 3 days per month of admin time can be required to deal with the

problems fully!

HOW CAN THIS BE SIMPLIFIED AND MADE MORE ‘AUTOMATED’?

Luckily there are options available for simplifying the accounting for online sales (ecommerce) through the use of software that can integrate (or link) the online platform e.g. Amazon, Shopify AND the Xero/Quickbooks accountancy software.

Products such as A2X, OneSaas etc can automate the transfer of information and ‘act like the bridge’ into the accountancy software (Xero/Quickbooks).

Monthly fees for this software will be required, but are based on the level of activity and numbers of

online stores being used by the business. There will also be work required to setup and configure the

software (to create the bridge) for the online transactions to be transferred into your accounts, BUT

once completed it will…

- Automate the transfer of the sales activity (on an hourly basis, where required) from Amazon, Shopify etc into Xero or Quickbooks.

- Bring in the individual (in most cases) sales, fees and charges, VAT.

- Enable a reconciliation with individual ‘payout’ amounts.

- Resolve the details of the ‘reserve’ where necessary.

The benefits are clear for businesses –

- access to immediate or ‘real time’ financial information

- very little of the 2 to 3 days per month of admin time that otherwise would have been required

- simpler completion of quarterly VAT returns

A2X and OneSaas etc can also be used to handle cost of sales, where these are available within the

online platform (SKU information required), and of stock management via access to Amazon FBA

figures.

If you want some advice or assistance with your online or ecommerce activities, please feel free to contact Sakura, as we can help you with A2X, OneSaas, Xero, Quickbooks, Stripe or Paypal!