Xero and quickbooks ‘cloud’ accountancy software – why ?

September 17, 2020

Although there are an increasing number of online (or cloud) accountancy software systems that are available for SMEs to use for their business, whether it is FreeAgent, the newly launched Sage Accounting, Kashflow, Big Red Cloud, Clearbooks along with a number of others, as an accountancy practice, Sakura took the decision more than 12 months ago, to focus on and specialise in only TWO – Xero and Quickbooks Online.

Why Xero and Quickbooks?

The key criteria behind this decision were:

- The extensive use of the software among small and medium sized businesses in the UK,

Ireland and beyond. - Continuous improvement and new developments in the software.

- Their ability to effectively manage the day to day bookkeeping in a ‘proper accounting way’.

- How ‘user friendly’ the software is for non accountants to use successfully.

- The flexibility in terms of setting up the software for different business types and sectors.

- The ability of the software to integrate (or link) with other business systems and apps

Why go to the ‘Cloud’ for accountancy software?

If your business is not already operating using ‘cloud’ accountancy software, then NOW is the time to make the change !

Even if you are using one of Xero or Quickbooks already, there is so much more functionality

available, that can be better used by businesses to make ‘day to day’ activities more efficient!

Also following COVID-19, we already know that there has been a general move by businesses to

more ‘online activity’, so there are now more than enough fundamental reasons for businesses to

focus on cloud accountancy software –

- HMRC’s ‘Making Tax Digital’ – this online project will develop across more of the tax

environment throughout 2022 and 2023 with more business transactions required in a ‘digital’

format each month or quarter by HMRC - Employee/staff time & efficiency – in this business environment it is more important than

ever, to optimise staff time and to reduce time spent on general administration e.g.

automation of the input of sales, bank activity, Paypal and other transactions - Key figures & numbers – business owners need (and want) easier and faster access to key

business figures and numbers i.e. better financial information = better business

decisions on margins, pricing, recruitment/retention, cashflow and business risks etc - Better business analysis – better control AND analysis of business activities enables higher

value decisions/actions to be taken more easily i.e. decisions on bank finance & faster

processing of applications, tighter cashflow management, more regular business forecasting,

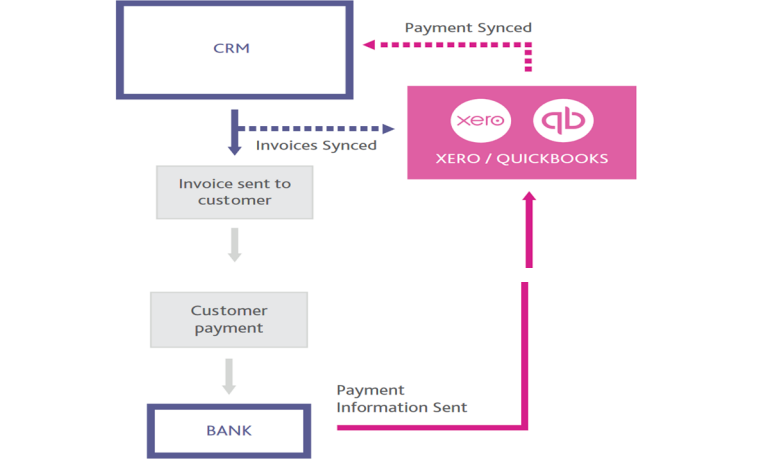

pricing reviews etc - System integration – more opportunities to integrate (or link) Xero or Quickbooks software

with other software and apps in the ever growing app ecosystem e.g. online sales ‘shops’,

retail POS systems, payments (Stripe/Paypal, GOCardless etc), stock management, credit

control etc

What is the big opportunity with integration of software and apps with Xero & Quickbooks?

The businesses that are able to more simply and quickly manage the ‘core’ or straightforward ‘day to

day’ transactions, and to accurately capture their business activity into the accountancy system on a

‘real time’ basis, means that as a business, they will have the ability to –

- Spend more time to liaise or speak with their clients.

- Continuously focus on improving customer experience and ‘day to day’ relationships.

- Understand where they are financially and react more quickly and effectively to the business

environment. - Plan ahead more effectively and make the right decisions on growing the business or

managing potential risks.

Some examples of where integrations can be implemented for various existing systems that are

already used by businesses, include the following:

- CRM systems – Autotask (IT software support), LEAP (Legal)

- POS software systems – EPOSNow, Clover (Hospitality and entertainment)

- Online Sales platforms – Amazon, Stripe, Ebay, Shopify

- Payments – PayPal, Stripe, SagePay

- Other – Stock management, Purchase orders, Quotes/Proposals, Credit control